All permanent employees of Eskom, its subsidiaries and of any other participating employer in the Fund who are younger than 65 years qualify for membership of the EPPF.

Read moreAll permanent employees of Eskom, its subsidiaries and of any other participating employer in the Fund who are younger than 65 years qualify for membership of the EPPF.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Justo donec enim diam vulputate ut pharetra sit. Est sit amet facilisis magna etiam tempor orci eu. Nulla pellentesque dignissim enim sit amet venenatis urna. Gravida neque convallis a cras semper auctor neque vitae. Ipsum dolor sit amet consectetur adipiscing. Faucibus pulvinar elementum integer enim neque volutpat. Nisl nisi scelerisque eu ultrices vitae. Fermentum dui faucibus in ornare. Rhoncus aenean vel elit scelerisque mauris pellentesque. Urna porttitor rhoncus dolor purus.

You may retire from the Deferred Pension Scheme anytime from age 55 to 65 years.

No, unfortunately not. The South African Revenue Service prohibits continuing contributions by a person to an employer sponsored retirement scheme after the person is no longer employed by the employer. As soon as you leave the service, you are no longer an active member and contributions must cease.

If you are an in-service member and leave your employer, you may transfer your benefit to the EPPF Deferred Pension Scheme. This means that you leave your pension benefit in the EPPF until your retirement date. The Deferred Pension Scheme allows you to leave your benefit in the EPPF while it attracts interest and grows. You will be able to retire from the Deferred Pension Scheme and access your benefit from the age of 55 years. You must retire from the Deferred Pension Scheme by no later than the age of 65 years.

You have three options on deferment:

You may retire from the Deferred Pension Scheme anytime from the age of 55 years until 65 years. When you retire from the Deferred Pension Scheme you have the option to take up to one third of your benefit in cash. The balance must be used to provide you with a monthly pension from the EPPF. To begin drawing a pension from the Deferred Pension Scheme, you must complete an Application for Retirement Benefits Form. If you wish to receive your pension in a bank account outside South Africa, you must complete the International Banking, together with the Application for Application for Deferred Benefit Pension. Log in to your profile to download both forms. Please note that you cannot access your funds for any reason before the age of 55.

If a divorce order was issued after you have already withdrawn from the EPPF, there is no pension interest left in the EPPF to be paid in terms of the Divorce Order. Pension interest refers to a resignation benefit that a member would have been entitled to had he resigned on the date of divorce. Because you have already withdrawn, the fund no longer holds pension interest on your behalf. Pension interest become a pension benefit on withdrawal. Therefore, the EPPF will be unable to make any payment of pension interest as that would be acting in contravention of the rules of the EPPF and the Pension Funds Act of 1956, which prevent the Fund from making any deductions from a member’s benefit if such a deduction is not in accordance with the Pension Funds Act read together with the Divorce Act.

The non-member spouse can claim payment of his/her benefit in terms of the Divorce Order directly from the deferred pensioner.

If you are married at the time of retirement, your spouse will receive a monthly pension upon your demise. However, if you marry after retirement, your spouse will not qualify for a monthly pension.

No, once a decision is made its irreversible. Deferred members cannot access their funds for any reason before the age of 55.

For Retirement, Death and Severance Benefits tax rates, go the South African Revenue Services’ website: Retirement, Death and Severance Benefits tax rates, on www.sars.gov.za.

All permanent employees of Eskom and all its subsidiaries and of any other participating employer in the Fund who are younger than 65 years qualify for membership of the EPPF.

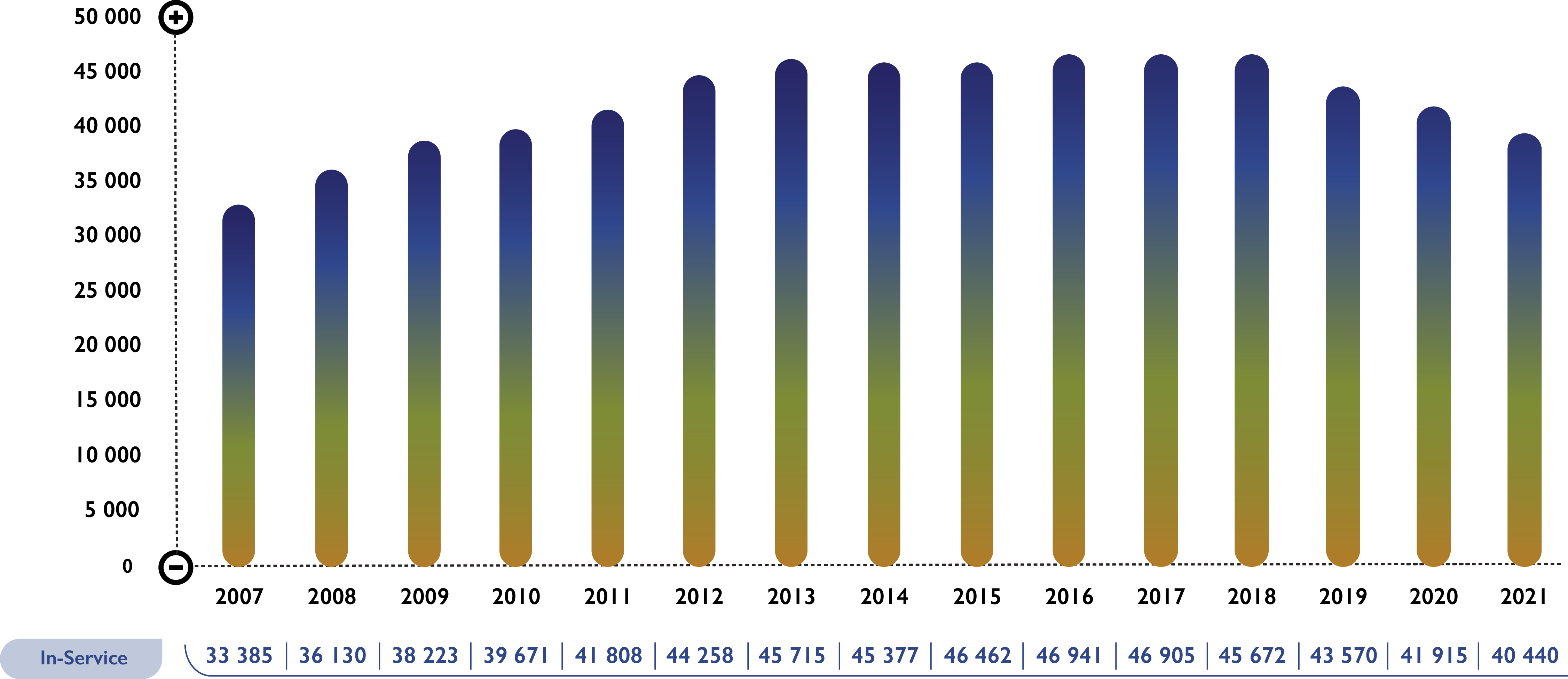

In-service members contribute a monthly, fixed percentage equal to 7.3% of their pensionable salary to the EPPF. The employer also contributes 13.5% of each in-service member’s pensionable salary towards the pension scheme. Members have the option to make additional contributions to their pension to increase the value of their pension benefits, this is known as the Additional Voluntary Contribution scheme.

Active Member Contribution Information

Active members contribute at a rate of 7,3% of pensionable emoluments. Members may make additional voluntary contributions as per the rules of the Fund. There is a very small group of members who contribute at lower rates of 6,0% and 4.0% of annual pensionable salaries.

Employer Contribution Information Participating employers contribute at a rate of 13,5% of pensionable emoluments

Normal Retirement

The normal retirement age is 65 years. However, in-service members may retire early from age 63 without penalties, subject to the employer’s conditions of service. The benefit is based on 2.17% of the in-service member’s annual average pensionable salary over the last year before retirement, for each year of pensionable service.

Early Retirement

An in-service member may retire early after reaching age 55 years. The benefit is a pension calculated in terms of a pension formula, reduced by the penalty factor of 3.9% per year for each year before age 63 years.

Ill-health retirement

An in-service member may retire at any age as a result of ill-health, provided that the Board of Trustees approves a recommendation by the EPPF Medical Panel in this regard. The benefit is calculated by making provision for a pension based on the in-service member’s pensionable salary and pensionable service accrued up to the actual retirement date plus 75% of the service that would have been completed by the in-service member from that date to the pensionable age.

Death before retirement

On the death of an in-service member, a lump sum equal to twice the member’s annual pensionable salary is payable and distributed in terms of the provisions of Section 37C of the Pension Funds Act.

Plus A widow/widower’s pension of the first 60% of the in-service member’s potential pension is payable to the deceased member’s spouse. The pension is calculated as if the in-service member had remained in service until age 65, based on the current pensionable salary.

Plus

A

child’s pension of 30% of the pension to which the in-service member would have

been entitled if he/she had remained in-service until the normal retirement

date, in respect of one eligible child. The children’s pension will increase to

40% in respect of two or more eligible children.

If there are no spouse’s or children’s benefits payable, a lump sum death benefit will be paid to the in-service member’s estate equal to the greater of:

- A lump sum equal to the in-service member’s annual pensionable salary;

Plus -10% of the final average pensionable salary per year of pensionable service;

Or

Twice the in-service member’s annual pensionable salary.

Death after retirement

On the death of a pensioner, a lump sum equal to R3000 is paid to the surviving spouse or the estate;

Plus

A monthly pension to the surviving spouse equal to 60% of the deceased pensioner’s pension at retirement before commutation, including any subsequent increases will be paid for life;

Plus

The qualifying child/ren (biological or legally adopted children under the age of 21) are eligible for the monthly pension until the age of 21.

A child’s pension of 30% of the pension to which the in-service member would have been entitled if he/she had remained in-service until the normal retirement date, in respect of one eligible child. The children’s pension will increase to 40% in respect of two or more eligible children.

If there is no spouse’s pension payable, the percentage in respect of a single eligible child is increased to 60% of the deceased pensioner’s pension at retirement before commutation, including any subsequent increases. For two or more eligible children, the total percentage is increased to 100% of the deceased pensioner’s pension at the time of retirement before commutation, including any subsequent increases.

If there are no spouse’s or children’s benefits payable, a benefit equal to the excess amount of the lump sum, as specified below, over the total benefits paid to the pensioner until the time of death is paid to the estate. The lump-sum comprises the following:

Plus

The greater of the two following calculations:

i. Twice the annual pensionable salary at retirement, less the pension benefits received since retirement;

Or

ii. The annual pensionable salary at retirement plus 10% of the final average pensionable salary per year of pensionable service, less pension benefits already received.

Withdrawal due to voluntary resignation, abscondment or dismissal

In case of a withdrawal benefit due to resignation, abscondment or dismissal a cash benefit is payable. This is the prescribed minimum benefit in terms of the Pension Funds Second Amendment Act.

The benefit is the greater of the following calculations:

i The capital value of the member’s accumulated past contributions plus interest after December 2001. The interest rate must compare reasonably with the actual rate of investment return, net of fees and costs that the EPPF has earned on its assets;

Or

ii Fair Value – the Fair Value pension is the amount of the pension that an in-service member has earned for past service up to the date of leaving the EPPF, based on the in-service member’s pensionable salary at the date of leaving the EPPF. The capital value of the amount is calculated using financial assumptions, approved by the Registrar of Pension Funds.

Withdrawal due to retrenchment before age 50

In the event of a retrenchment of an in-service member, the benefit payable will be equal to the greater of:

- The benefit payable on withdrawal due to voluntary resignation, abscondment or dismissal;

Or

iii Third calculation - In the event of a negotiated cash settlement or retrenchment of a member, a benefit of three times the member’s own annual contributions becomes payable. The EPPF must then pay to the member the greater of the first, second or third calculations.

Withdrawal due to retrenchment after age 50

If an in-service member has 10 years continuous service, he/she qualifies to receive a pension instead of a lump sum benefit, as approved by the employer. The employer will compensate the EPPF accordingly.

Deferred pension option

An in-service member may, instead of taking a cash benefit, become a deferred pensioner and may be granted a benefit equal to the actuarial value, as determined by the actuary, in respect of completed service. The deferred benefit may be accessed from the date of deferment up to the age of 65 (64 year and 11 months).

Pre-Retirement Counselling

All members exiting the Fund are required to meet with a Retirement Fund Consultant (RFC) six months before their exit. The purpose of the benefit counselling is to assist and provide you with information needed to make an informed decision when retiring. The RFC will also guide you as to what is required in the completion of the Retirement application form.

Retirement application

The member with the help of Human Resources (HR) must complete the application form.

This application form is used to process the pension as per the member’s instruction.

If previously divorced, members are encouraged to submit their divorce documents to the Fund to prevent delays in processing as the divorce documents are to be reviewed by the Fund’s legal team.

Documents

All documents requested on the application form must be provided to the Fund before the member’s exit where the quality assurance pertaining to the documents can be completed. These can be provided electronically.

Last Contribution

The EPPF will wait for the final confirmation and the last contribution. The contributions are received from the employer by the 7th of the month after your retirement and once allocated. Thereafter, the applicable interest rates are loaded at which time the claim processing commences.

Calculation

The member’s final retirement calculation is done in accordance with the Fund rules.

Tax

The retirement calculation is sent to SARS to confirm the tax deductible on the benefit.

Cash lump sum

The member is paid the Nett cash lumpsum value if he/she has opted for that.

Monthly Pension

The arrear monthly pension is loaded along with any deductions as indicated by the member. Thereafter, the pension will run monthly in advance by means of the EPPF’s payroll system.

Letter

The member is sent a welcome letter providing them with their monthly pension value and the tax certificate.

Pensioner Card

The card is produced and posted to members which enables them to get discounts, this could be store or region specific.

Counselling

All members exiting the Fund are required to meet with a Retirement Fund Consultant upon their exit. This will provide them with the information they need to make an informed decision when withdrawing.

Withdrawal Application

The member with the help of Human Resources or an RFC must complete the claim form. This claim form is used to process the withdrawal benefit as per the member’s instruction. If previously divorced members are encouraged to submit their divorce documents to the Fund to prevent delays should the divorce be legally binding on the Fund.

Documents

All certified supporting documents requested on the application form must be provided to the Fund together with the claim form before the exit date.

Uploading

The withdrawal claim form together with the supporting documents are securely uploaded to the EPPF’s administration system.

Last Contribution

EPPF awaits the final confirmation and the last contribution from the Employer before starting the withdrawal process. The contributions are received by the employer by the 7th of the month after your exit date. The Earnings Yield Rate is also updated for the month. Thereafter the contributions are uploaded and the processing of the claim commences.

Calculation

The member’s final withdrawal calculation is done in accordance with the Fund rules.

Tax

The withdrawal benefit is sent to SARS to confirm the tax deductible.

Cash Lump sum

The Nett cash lumpsum after the deduction of tax from the cash lumpsum is paid out. Members who elect to transfer/preserve their benefit have the payment made directly to the institution they selected.

Letter

A payment letter detailing the lumpsum, tax and nett amount paid and the member’s IRP5 certificate is posted to confirm that the claim has been finalised.

The Fund is notified of the death by the employer.

The employer provides the Fund with the completed death application form. This form provides the details of the spouse and eligible children, if applicable.

The employer provides the Fund with the relevant supporting documents as indicated on the application form along with any additional information as required from time-to-time.

The Fund uploads the application form and supporting documents securely onto the EPPF’s administration system.

The final pension value is calculated in accordance with the rules of the Fund.

The lumpsum benefit is sent to SARS to confirm the tax deductible.

The monthly pension values along with any deductions as indicated on the application are loaded.

The arrear monthly pension is paid. Thereafter, the pension is run in advance by means of the EPPF’s payroll system on a monthly basis.

A payment letter is sent to the beneficiary(ies) providing them with the details of their monthly pension.

A monthly payslip is provided to each recipient of a pension.

The calculated death lump sum benefit is referred to the Fund’s Benefits Investigation team to conduct the Section 37C of the Pension Funds Act dependency investigation.

The Benefits Committee puts together a recommendation regarding the distribution of the lump sum Death Benefit for the Trustees to review and approve.

NB – the law allows this process to take up to 12 months to ensure that a proper investigation is done to identify beneficiaries.

The Fund is notified of the divorce by the non-member spouse (applicant).

The final divorce decree as granted by any court of law is sent to the Fund’s Legal team for their confirmation on whether the divorce is legally binding on the Fund.

Legal department advises on how the divorce benefits should be calculated as stipulated on the final divorce order.

The Fund notifies the claimant of the outcome and sends the divorce application form (Form 3B) to the claimant for their completion.

The non-member spouse is required to submit the divorce application form together with an original certified copy of ID, marriage certificate, proof of bank account details and proof of SARS tax reference number.

The non-member spouse record is created for processing of the divorcer claim.

The non-member spouse divorce settlement calculation is done in accordance with the Fund rules and time periods stipulated by the Pension Funds Act

The tax directive is requested from SARS.

Member is notified of the divorce claim and the impact on their pension benefit by email or telephone.

The nett amount after tax deduction is paid to the claimant bank’s account. If the claimant opted for their benefit to be transferred to an external fund, payment is made directly to the Fund and provide the Fund with poof of payment.

The non-member spouse payment letter and tax certificates is posted to the address provided.

Member is issued with an adjusted benefit statement.

It is to be noted however, that the fact that the Fund had no distributable surplus, does not mean that the Fund is in financial difficulties. As it were, 30 June 2003 (the EPPF’s surplus determination date) coincided with one of the worst investment periods in South Africa in many years and any surplus that the EPPF may have had before that date, was severely affected, as in many other funds. While the EPPF had no distributable surplus on 30 June 2003 for the purposes of the surplus redistribution legislation, in actuarial terms it was and still is fully funded and able to match its financial liabilities with corresponding assets.

i. Paid-up benefits inside the Fund

The benefit will remain invested in the Fund’s current investment portfolio, it is recommended that you seek financial advice for this selection.

There are:

No tax consequences;

No additional administration fees

No up-front costs

No forced disinvestment

A paid-up benefits certificate will be issued to all members whose retirement savings are preserved in the fund. Your retirement savings will, by default remain in the Fund’s current investment portfolio. Members who are paid-up may not make further contributions towards the Fund.

ii. Transfer a part or the whole benefit to another approved fund

You may transfer your full benefit, or a portion thereof, to another approved fund in South Africa. Approved funds are another employer’s pension or provident fund, a preservation pension fund, preservation provident fund or a retirement annuity.

Transfers to another employer’s pension fund, a pension preservation fund or a retirement annuity are tax-free. Transfers to a preservation provident fund or an employer’s provident fund are taxable.

iii. Defer a part or the whole benefit to the EPPF Deferred Pension Scheme

You may transfer your full benefit, or a portion thereof, to the EPPF’s Deferred Pension Scheme.

You have three options on deferment:

Defer the full value of your benefit in the Deferred Pension Scheme;

Take a maximum of R25 000 of your total cash and transfer the balance to the Deferred Pension Scheme; or

If you have been retrenched you may take a cash refund equal to your accumulated member contributions (less tax – taxed at the rate applicable on withdrawal) and transfer the balance to the Deferred Pension Scheme.

Each year, the EPPF will send you a Deferred Benefit Statement, which informs you of the rate of growth of your benefit in the Deferred Pension Scheme.

iiii. Take the entire benefit in cash

You may elect to take your entire benefit in the EPPF in cash.

The tax payable on the withdrawal benefit is determined by the Second Schedule to the Income Tax Act. The tax on the lump sum benefit is set out in the withdrawal and retirement tax tables which are available on the SARS website (you can insert the link)

You may not transfer your benefit directly from the EPPF to another fund outside South Africa. If you wish to preserve your benefit in another retirement investment vehicle outside South Africa, you must withdraw the benefit and take your exit benefit in cash and then invest in another retirement funding arrangement outside South Africa.

If at any point you return to the service of Eskom or a participating employer in the EPPF after having deferred your benefit in the EPPF Deferred Pension Scheme, the benefit in the Deferred Pension Scheme will remain separate and will be retained there until you retire from the EPPF.

When returning to the service of Eskom or a participating employer, you will re-join the EPPF as a new member and your contributions will be held separately from the Deferred Pension Scheme. When you retire from the EPPF, you must also retire from the Deferred Pension Scheme.

If you wish to enhance and increase your benefit in the EPPF, you may make additional contributions to the Additional Voluntary Contribution (AVC) Scheme. Additional contributions to the AVC Scheme can be made monthly, once-off or on an ad-hoc basis, as and when you are able to make the additional contributions.

You may increase or decrease your contributions to the AVC Scheme at any time.

Additional contributions must be deducted from your salary through your payroll department and may not be deposited directly into the EPPF’s account.

The EPPF sends members who contribute to the AVC Scheme a tax certificate each year, in respect of their contributions. The certificate reflects the contributions, interest and bonuses, if any, earned. Interest on the Scheme is declared by the Board of Trustees on a quarterly basis. Click here for the updated interest rates.

Your benefit in the AVC scheme is added to the calculation of your benefit on withdrawal, retirement or death and increases the value of your benefit.

If you wish to transfer a benefit from a previous employer into the Fund when you join the Fund, this benefit is also allocated to your AVC Scheme.

Members do not get employer contributions upon withdrawal. The calculation of the withdrawal benefit is derived from their accumulated contributions or their fair value as at withdrawal.

i The capital value of the member’s accumulated past contributions plus interest after December 2001. The interest rate must compare reasonably with the actual rate of investment return, net of fees and costs that the EPPF has earned on its assets;

Or

ii Fair Value – the Fair Value pension is the amount of the pension that an in-service member has earned for past service up to the date of leaving the EPPF, based on the in-service member’s pensionable salary at the date of leaving the EPPF. The capital value of the amount is calculated using financial assumptions, approved by the Registrar of Pension Funds.

If you become permanently or physically disabled, or become incapacitated and are no longer able to work, you may go on ill-health retirement, subject to the recommendation of the EPPF’s Medical Panel and the approval of the Board of Trustees.

The benefit on ill-health retirement is calculated using the retirement benefit calculation formula of “Final Average Salary x Years of service (calculated in months) x Pension Rate” as follows:

The service portion of the formula is based on pensionable service accrued up to your actual date of ill-health retirement; plus 75% of the service that would have been completed from the date of the ill-health retirement to the normal retirement date. If your ill-health retirement was due to a pre-existing condition which you had before joining the employer and the EPPF, this portion of the benefit will be reduced to 50% of the service that would have been completed from the date of the ill-health retirement to the normal retirement date.

If you have ever been divorced or get divorced in future, you pension fund benefit may be impacted. When you get divorced, the settlement reached around the division of your estate, including the pension interest is between the two parties and is reflected in the divorce order. If your former spouse claims a percentage of your pension the claim against your Fund benefit is a percentage determined in the settlement reached.

All your pension benefits will therefore be calculated using your adjusted deem start date and taking into account the reduced benefit. This means that all you benefits i.e., resignation, ill-health, death benefits will now be calculated using the adjusted Deem Start Date.

You as the member of the EPPF, or your non-member former spouse can advise the EPPF of the divorce order. The following documentation must be provided to the Fund on submission of the claim:

A certified copy of the divorce order;

The claimant’s bank details (an original bank statement or a letter from the bank with a bank stamp;

An original certified copy of the claimant’s identity document;

A completed Form 3B, which can be obtained from here

When all documentation is completed and received by the EPPF, the divorce order is validated by the EPPF’s Legal and Technical Services Department, the Fund pays within 60 days of receipt of all complete documentation.

The deduction of the pension interest reduces your benefit in the EPPF from the date of payment of the pension interest and this also leads to an adjustment of your Deem Start Date (your date of joining the Fund).

For more information on the annual tax applicable, visit the SARS website on www.sars.gov.za.

We cannot pay withdrawal benefits to third parties.

A member can opt to go on early retirement once they turn 55 years. However, members who go on early retirement before the age of 63 will incur penalties. If members retire after the age of 63, no penalties will be incurred. It is therefore very important for a member planning to go on early retirement to have a discussion with their employer to discuss who will bear the penalty cost.