Helping EPPF members understand the Two-Pot Retirement System.

What is the Two-Pot Retirement System?

National Treasury has defined the two-pot retirement system as a measure that will allow members of a retirement fund to make partial withdrawals from their retirement savings while still in employment. This will allow people to access cash if they need it without resigning. Even if some cash is accessed, the bigger portion of retirement savings will be maintained for you until retirement to allow you to be able to retire with a financial safety net.

Does this mean I can access all my retirement savings before I actually retire?

No. The introduction of the two-pot retirement system is intended to help you make partial withdrawals from your retirement savings once a year so that you maintain the bigger portion of your retirement benefits for when you need it during retirement. When the two-pot retirement system comes into effect, it doesn’t mean that you should access available funds from your retirement savings. It’s always advisable to only make a withdrawal if you desperately need access to the funds. If you preserve more of your retirement savings, you’ll have more funds available upon your retirement.

When will the system be in effect?

The Finance Minister referenced the two-pot retirement system during his Budget Speech in February 2024. He said South Africans would be able to participate from 1 September 2024. In terms of law, the Revenue Laws Amendment Bill has been passed in the National Assembly. The usual passage of legislation is through the National Assembly, then the National Council of Provinces, before the President signs the bill into an act of law.

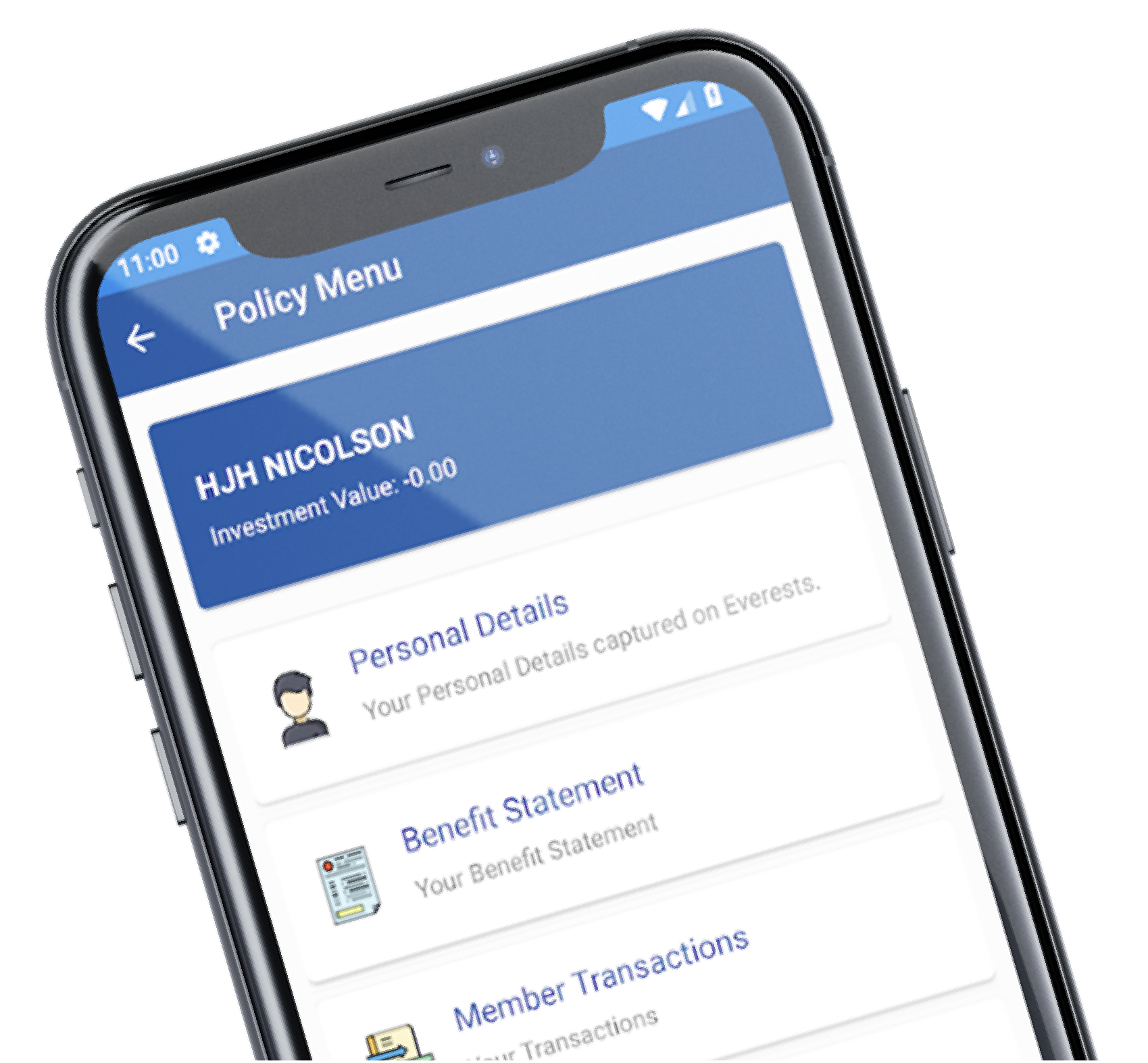

How will the Two-Pot Retirement System work for me as a member of EPPF?

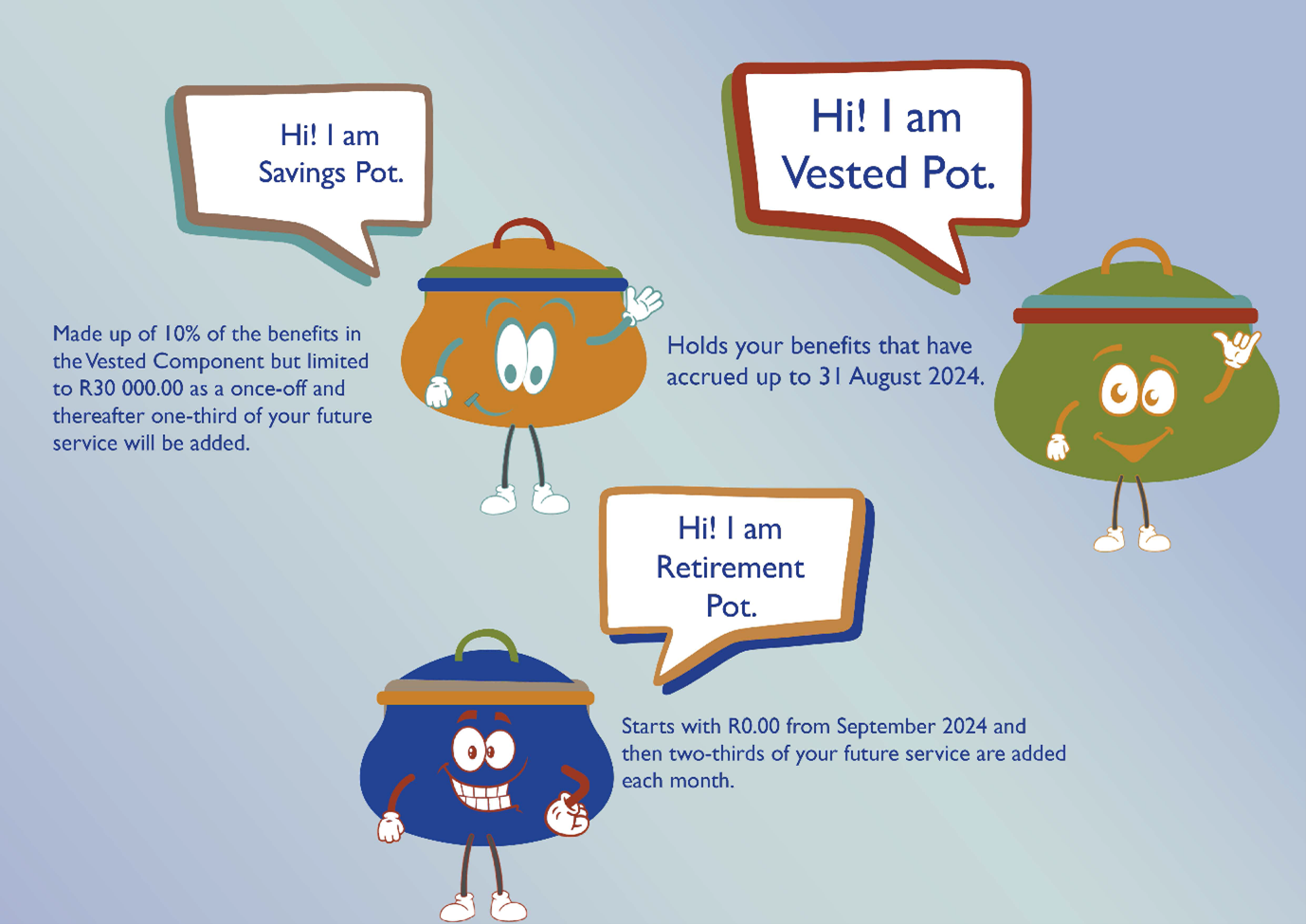

As an EPPF member, you need to know about your:

• Vested Component,

• Savings Component, and

• Retirement Component.

Here’s how they come together:

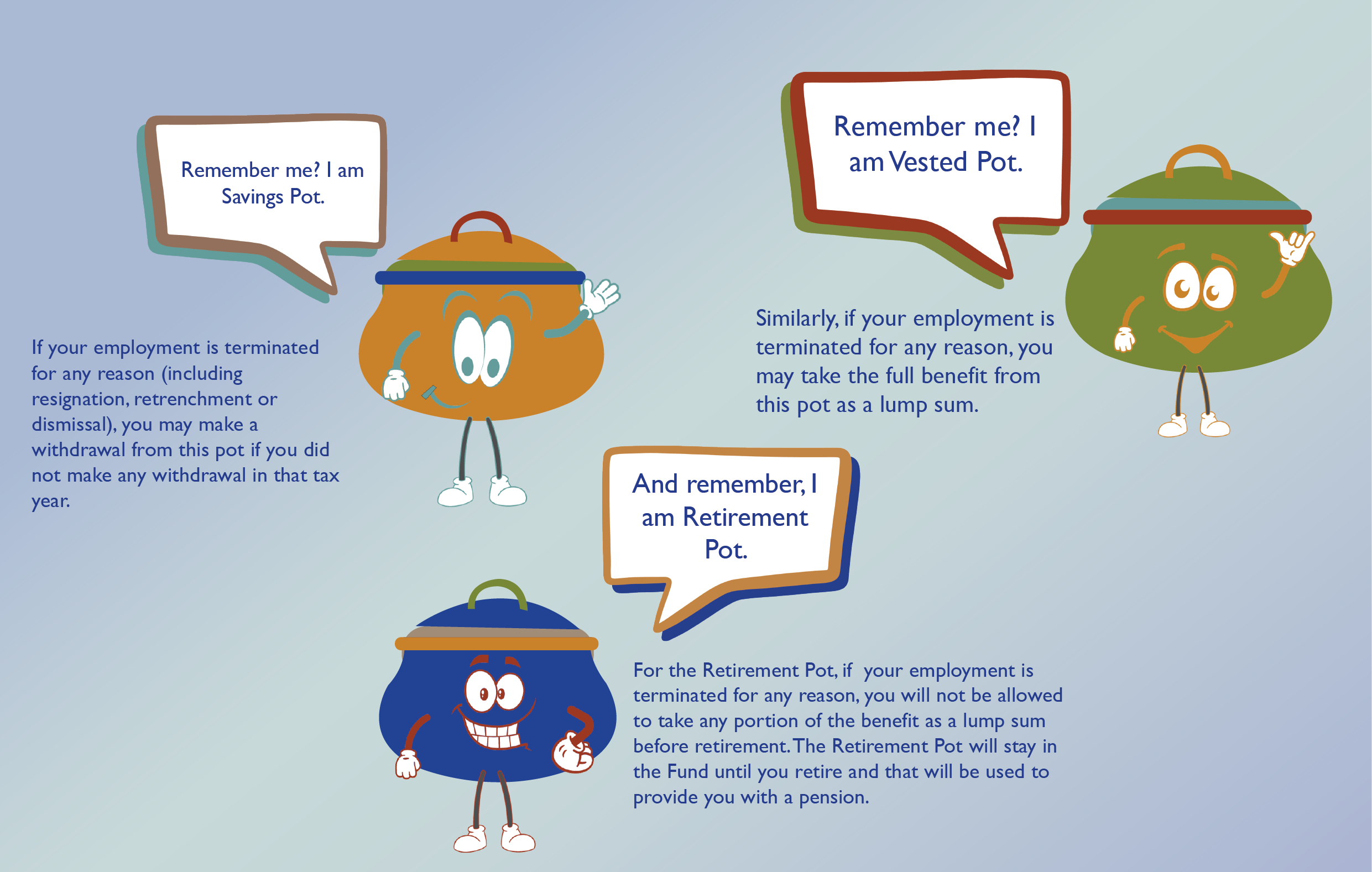

As an in-service member, you’ll be allowed to make one withdrawal per tax year from the Savings Component. However, this withdrawal will not be allowed if you have less than R2 000.00 in your Savings Component. Also any withdrawal will be taxed as income at your marginal tax rate. We will need to apply for a tax directive on your behalf before the cash can be taken.

How will I know how much I can withdraw?

If you have accrued more than R30 000.00 before 31 August 2024, you will have 10% of that amount, up to a maximum of R30 000.00, placed in your Savings Pot, allowing you to make a withdrawal. It’s important to understand that from 1 September 2024, all money in the Savings Pot (equivalent to one third of your monthly service) will be available for withdrawal once every tax year, provided there’s a minimum of R2 000.00.

Why should I consider my options before withdrawing my money?

The purpose of retirement savings is to allow you to be able to retire after a lifetime of hard work, safe in the knowledge that your money will be enough to sustain you in your twilight years. However, you may need cash for an emergency. If your one third in the Savings Pot is more than R2 000.00 at any point and you haven’t taken your withdrawal for that year, then you can withdraw the full amount irrespective of its value. What’s important is that waiting for the amount to accumulate before withdrawing will allow you to withdraw an even higher sum, which may be more helpful to your plans.

What about retirement benefit contributions made after 1 September 2024?

As a member of a defined benefit fund, your benefit is calculated based on pensionable service. This means that we don’t split money, but we split pensionable service instead. Your two pots will therefore only be filled from each month of service that you accrue from 1 September 2024.

Is the Two-Pot Retirement System optional for me as a member of EPPF?

You do not have to sign up for the two-pot retirement system and withdrawing available cash from your retirement savings will be entirely optional. EPPF will explain the processes to withdraw cash in the months leading up to the system coming into effect.

What happens if I resign, am retrenched or if I’m dismissed?

You will also be allowed to transfer your benefits to another fund if your employment is terminated for any reason.